Take your business travel to the next level

How much can you save on business travel?

Use the free savings calculator to see how much you can save on flights, accommodations, and more with Booking.com for Business.

Start saving more on business travel

Plan and arrange complete business trips for free

- Enjoy reduced business rates and earn loyalty points from your favorite hotels, airlines, and car rental companies

- Access complimentary travel support from CWT via email or phone whenever you need it

- Get up to 20% off standard rates with the Genius loyalty program

- Redeem non-refundable unused flight tickets by turning them into travel credits

Manage your business trips in one place

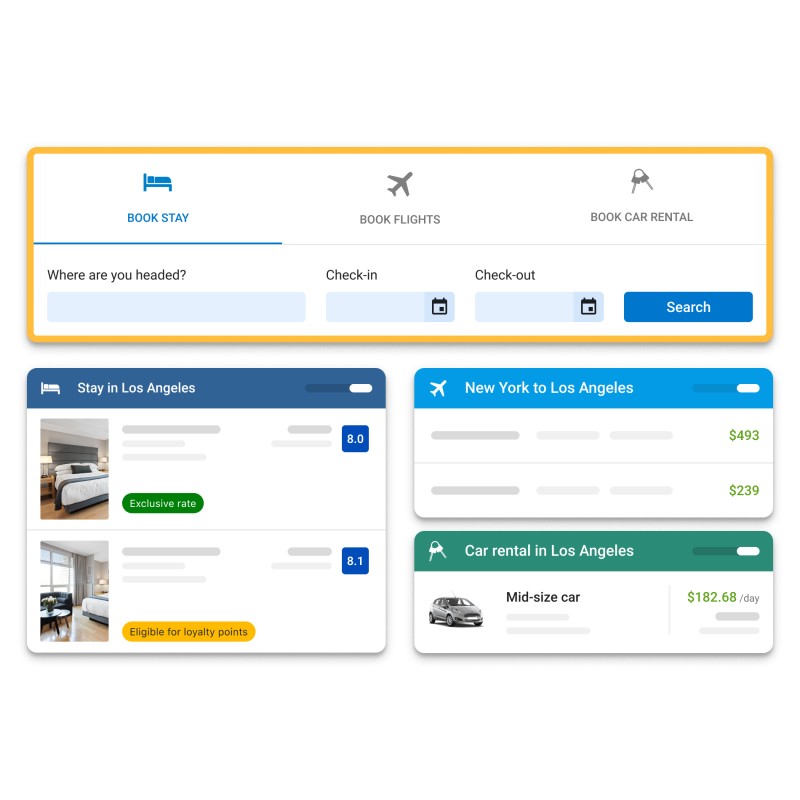

The all-in-one platform to book and manage flights, accommodations, and car rentals

- Easy-to-use reporting for a complete overview

- Safer business travel with the traveler safety map

- 232 million verified guest reviews

- Quick, easy, and completely free to use

Business travel made easy for everyone

That’s why 100,000+ companies trust Booking.com for Business with their travel

Business travel management for the whole team

Booking.com for Business has a range of features that make business travel easy for everyone.

For business owners

- Access exclusive business rates

- Save up to 20% on bookings with the Genius loyalty program

- Get complimentary 24/7 travel support for all employees

- Have full visibility of your company's travel expenses

- Ensure employee safety with the traveler safety map

For bookers and planners

- Manage multiple bookings with ease for all travelers

- Book flights, accommodations, and car rentals in one place

- Get complimentary 24/7 travel support

- Have a full, detailed overview of travelers' itineraries

- Book accommodations for groups of up to 30 people

For travelers

- Get complimentary 24/7 travel support

- Earn loyalty points from hotels, airlines, and car rental companies

- Read 232 million verified guest reviews

- Get personalized recommendations based on your previous bookings

- Earn rewards with the Genius loyalty program